Amazon's Marketplace Problem

Amazon is the unquestioned leader of selling stuff online. Over half of US adults are Amazon prime members.1 They are US ecommerce for many shoppers.

And yet there is a growing problem with shopping on Amazon. It isn’t as simple or easy as it has been in the past. Shoppers are now flooded with choices that are difficult to sift through.

Shopping on Amazon is not an enjoyable experience. For the most ‘customer centric’ business, this seems like a growing problem. Paradox of choice and poor peer reviews compromise the user experience.

— Post M. (@Post_Market) September 3, 2020

As several smart people in the thread above point out, Amazon doesn’t have the best shopping experience, but it does have the best buying experience.

However, focusing on buying at the expense of shopping has presented a major risk. Shoppers are finally figuring out what Amazon really is. A marketplace.

The Buy Box: A Market Where the Consumer Wins

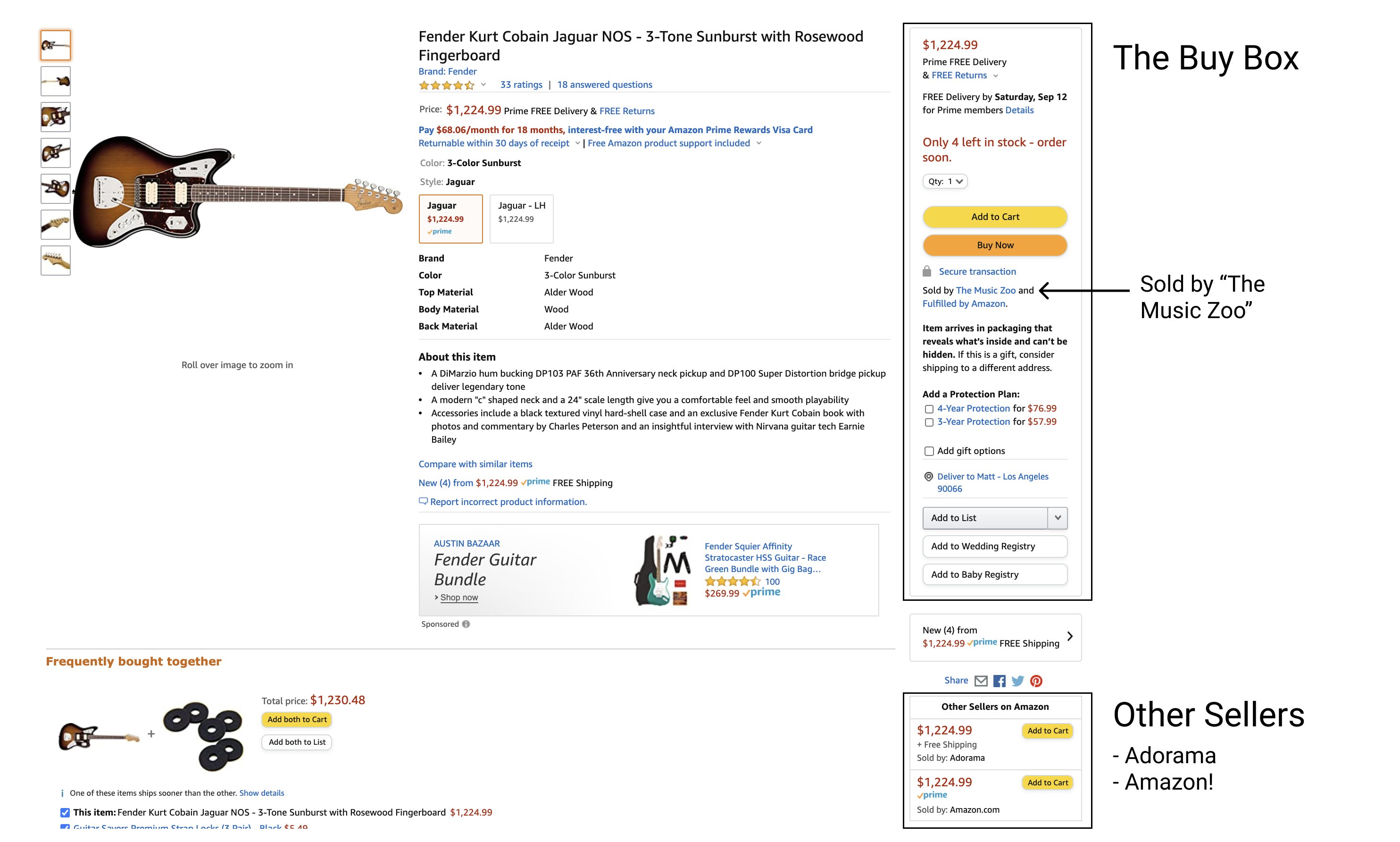

Over the past decade, the Amazon marketplace has been hidden from consumers through the ingenious “Buy Box”.

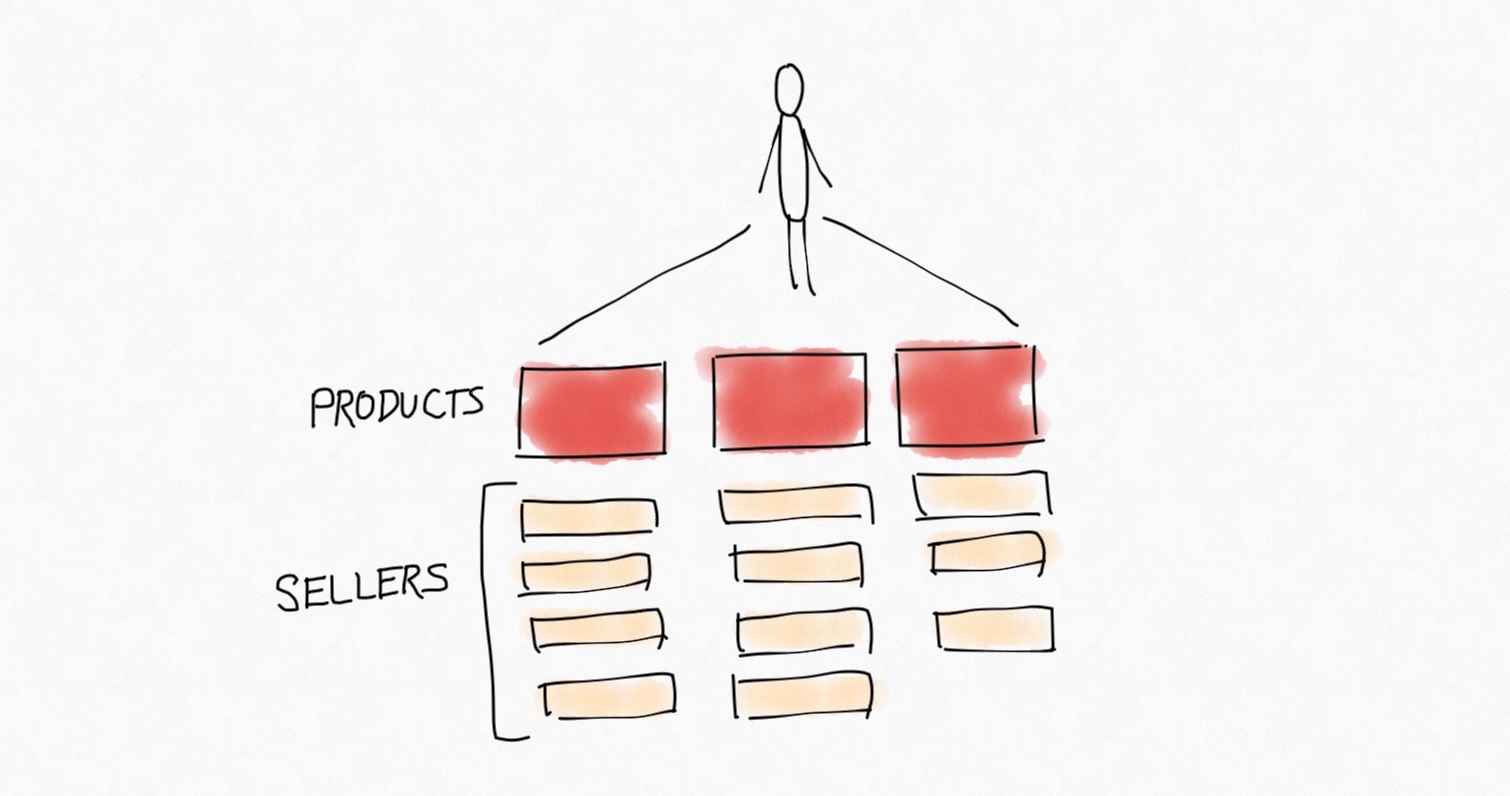

The Buy Box is an opportunity for Amazon to create a mini-market inside of every product page. Through a complex system that factors in price, reviews, inventory levels, and dozens of other factors, they dynamically select which seller’s product gets purchased when a shopper clicks the “Buy Now” or “Add to Cart” buttons. Over 80% of the time, the default buy-box merchant remains selected 2. Because of this stickiness, winning the Buy Box is essential for sellers. They need to provide good service and low prices to ensure they stay on top.

While this drives sellers crazy 3, it’s a huge win for shoppers. Despite the dozens of potential sellers offering the same product, complex choice is cleanly abstracted away. Since Amazon slowly layered this on over time, it’s generally imperceptible to shoppers. And best-in-class logistics like Fulfillment by Amazon (FBA), made their strategy impossible to replicate.

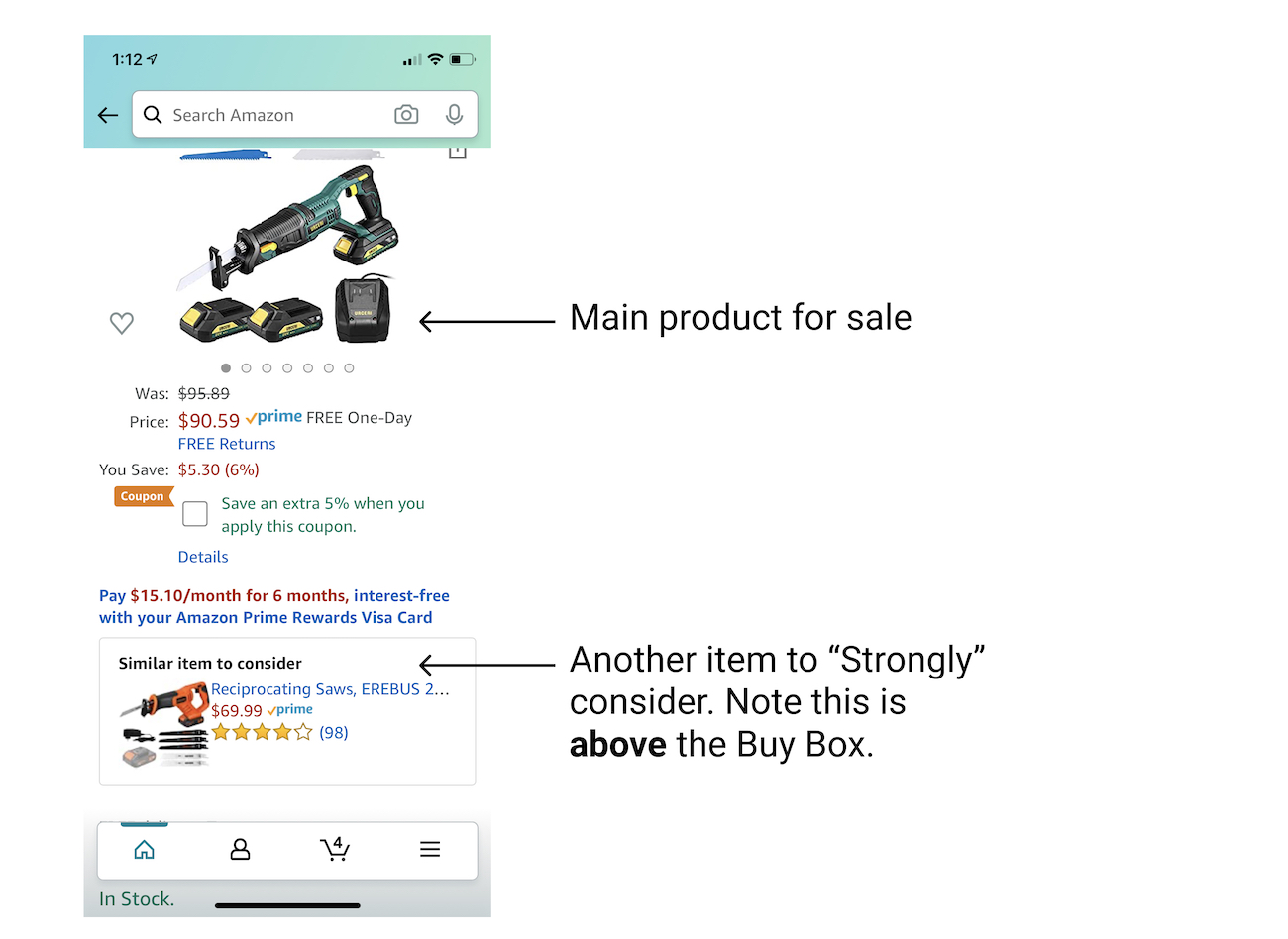

Looking to the future, mobile only accelerates this trend. You have less real-estate to even see and compare the other seller options.

SKU Proliferation: The “Retailer” Myth Crumbles

Since Buy Box competition is high, the primary way to differentiate as a seller is through the creation of new products. Why compete against other sellers, when you can create your own products, for which you own the Buy Box 100% of the time?

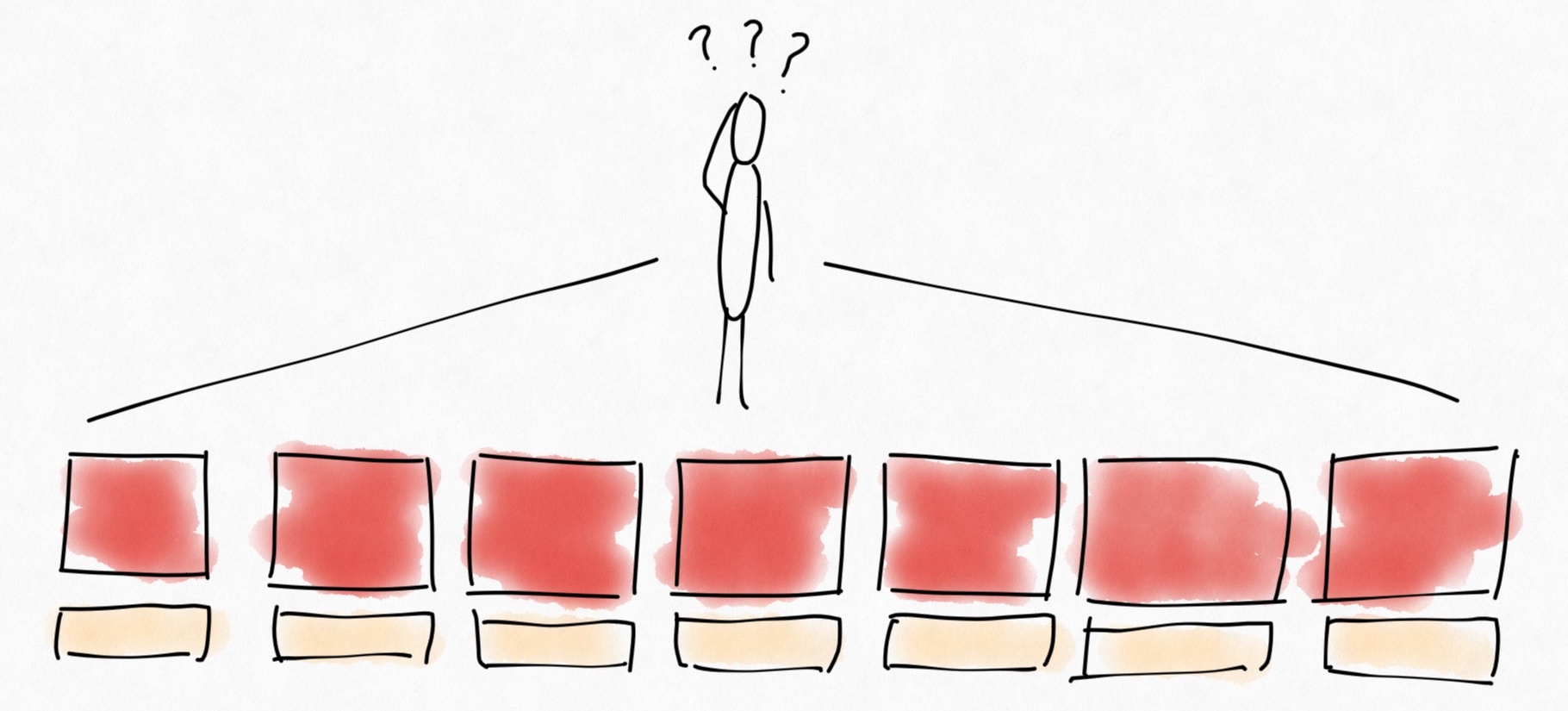

This is a big problem for Amazon. It means that suddenly you have a huge increase in the number of unique products, with little competition on each product page. Amazon can’t leverage their Buy Box magic for a shopper. Instead shoppers are forced to wade through the messy market themselves.

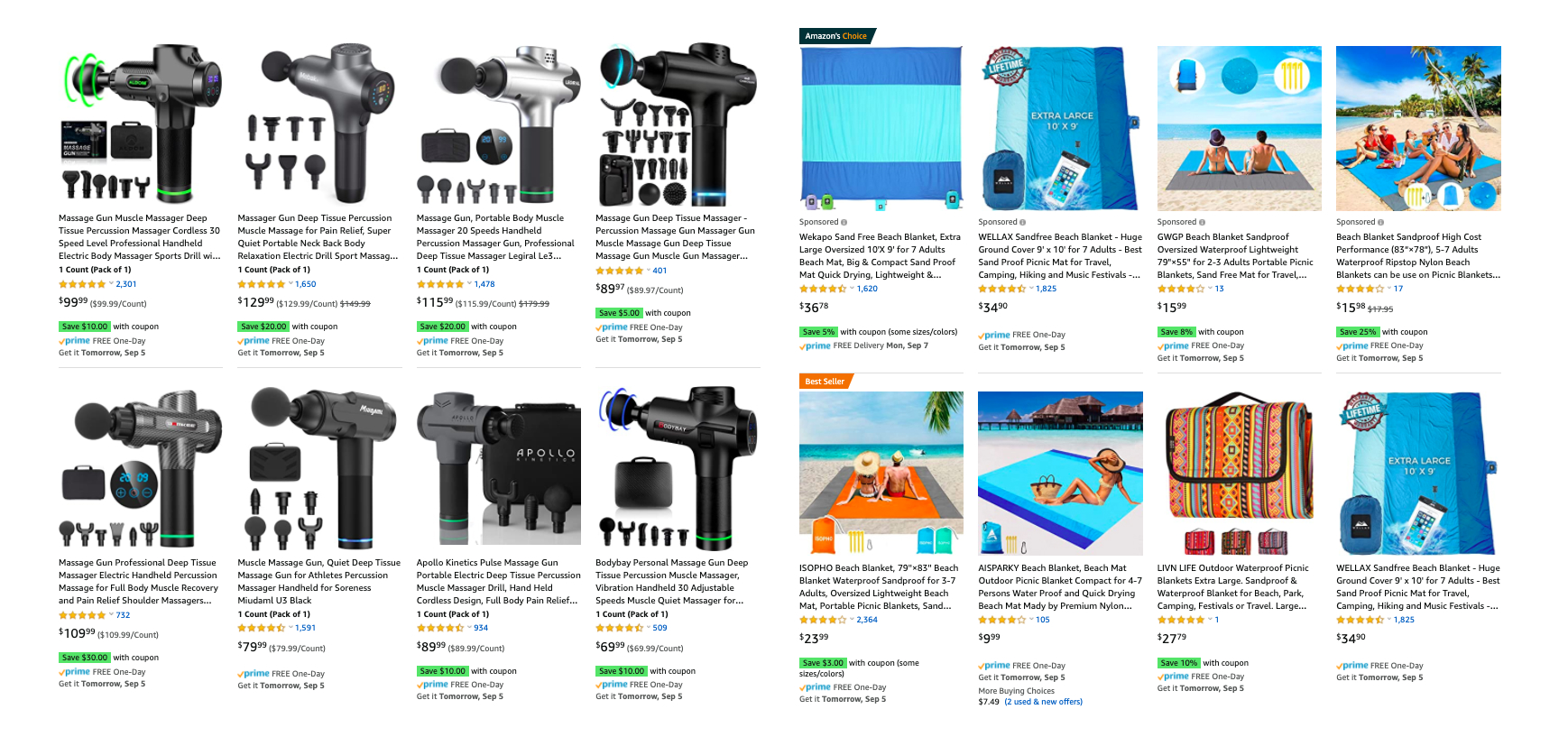

If you want proof of this, start at the Today’s Deals page and perform searches for some of the products you see promoted. There are hundreds of similar products across a variety of categories that look nearly identical.

As the number of unique saleable goods increases, sellers are no longer hidden behind competition on individual product pages. And shoppers for the first time start seeing search results that look a lot like eBay.

Shopping Isn’t Customer Centric.

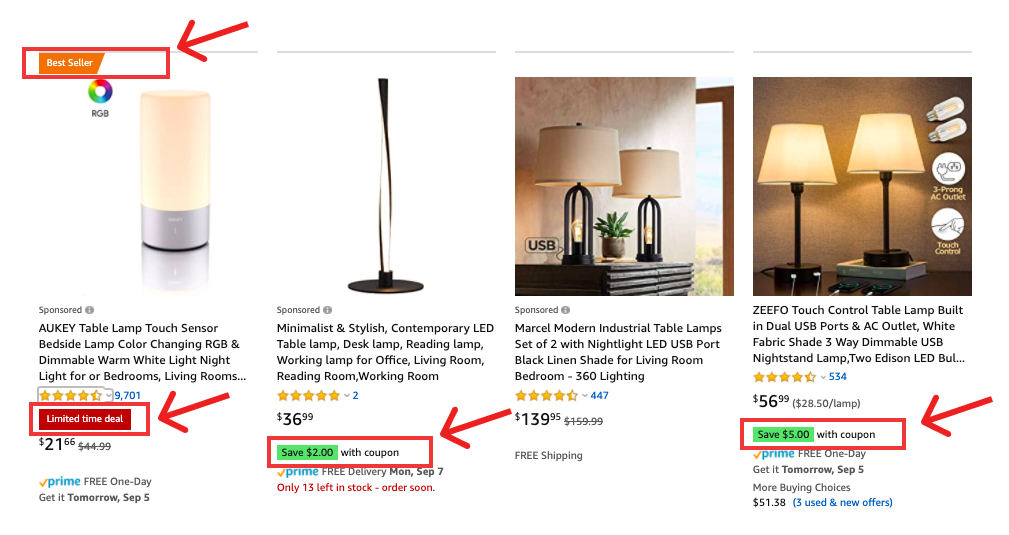

Amazon has further painted themselves into a corner because they’ve intentionally chosen to monetize the shopping experience through ads, deals, coupons, and promotions. Sellers can spend money to improve their visibility and Amazon will willingly take it.

You can see the effect that this has on search results. Many of the results you see are paid, and even the organic results have coupons or other paid add-ons to tempt shoppers.

While label’s like “Amazon’s Choice” are occasionally helpful, these seem like overly subjective and ultimately weak signals.

What Now?

Amazon appears to have two paths forward. The first is to drown out the noisiness of the marketplace. Amazon is approaching this through a constant series of bets around discovery (e.g. experiences like Amazon Live) and iterating on search result layouts. They’ve also pushed agressive redirection on product pages, in the event that a user landed on a product that wasn’t the “best choice” (in their estimation).

The second option is a large-scale culling of underperforming and low-quality sellers and inventory. It seems inevitable that they’ll need to take some action here, if only to address some of the counterfeiting issues they’ve faced in the past.

In the absence of truly threatening competition, major action seems unlikely. But as a Prime member, I hope they invest in making shopping a significantly more enjoyable experience. Left unchecked, this gap could turn into an existential risk.

-

As of December 2019, 112M Americans are Amazon Prime members. ↩

-

https://www.bigcommerce.com/blog/win-amazon-buy-box/#wrap-up ↩

-

There are dozens of businesses dedicated to helping sellers reprice their products and win back the Buy Box (e.g. Repricer). ↩